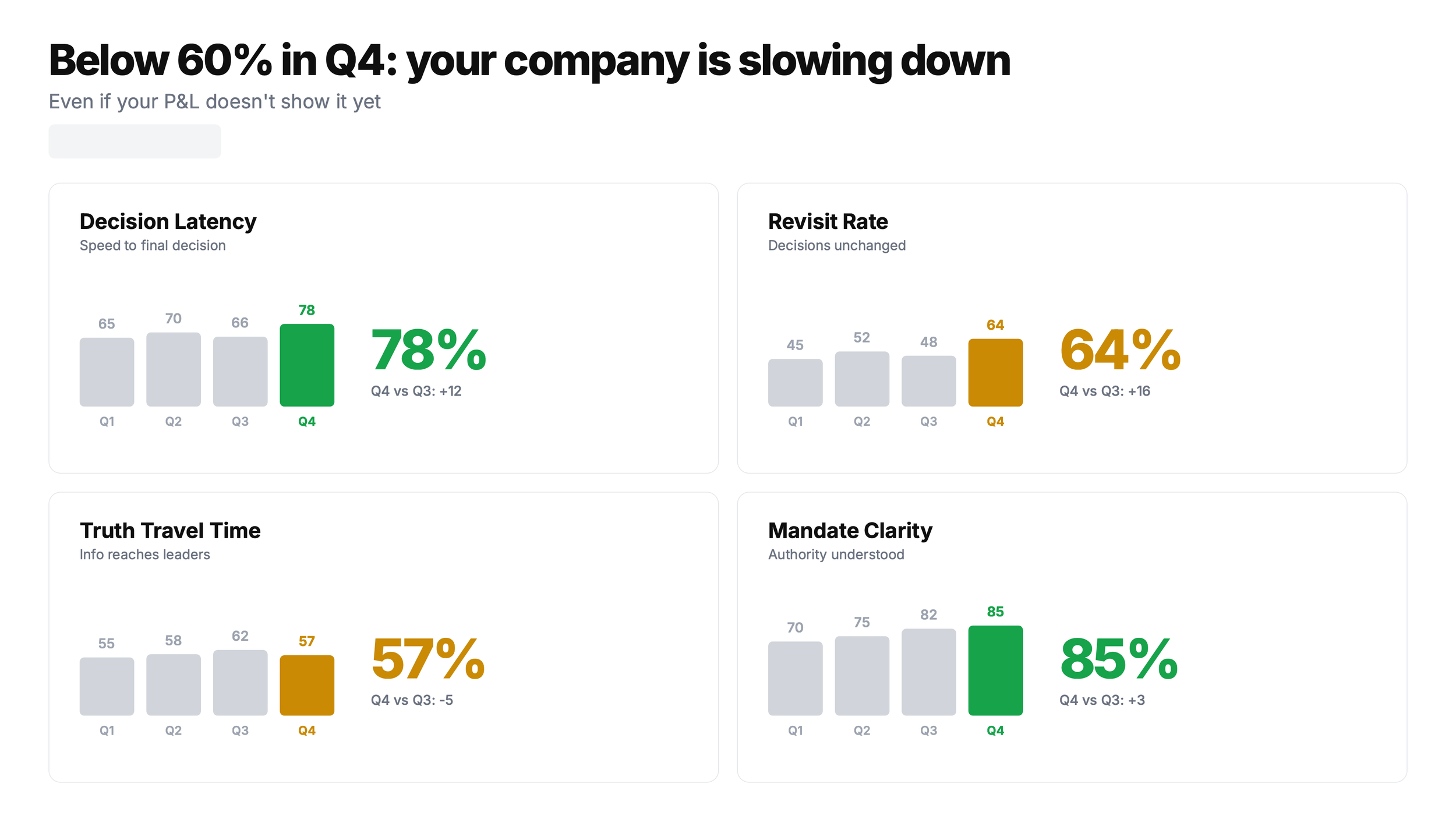

Below 60%: When Your Company Is Slowing Down

A score below 60 percent is an early warning. Execution slows, decisions drag, and risk builds long before it shows up in the numbers.

Four behavioural signals that show up 90 days before your P&L does.

A founder recently showed me his numbers, and they looked healthy. Revenue on plan. Pipeline green. Cash runway stable, all good.

Then he said something that did not match the numbers:

“I think we’re slowing down. I can’t just put my finger on exactly what and where to start”

He was right. The warning signs were there, subtle and not obvious. They were not yet showing in the P&L.

Here’s what’s going on:

Performance tells you what happened. The numbers are history. If you want to look into the crystal ball, you must start measuring your business behaviour.

This is the trap many SMEs are walking into.

Most companies measure outcomes, then reverse engineer a story and a conclusion to follow. Typically something like this:

When the quarter is good, the story is execution.

When the quarter is bad, the story is the market or product.

Behaviour sits underneath both stories. Behaviour is the mechanism.

I call it behaviour debt.

When behaviour changes for the worse, you get slower. You do not collapse immediately. And slow compounds.

What you can measure before the numbers move

You stop waiting for the P&L to give you permission to act.

You start measuring the stuff that moves before the numbers move: time, rework, silence, mandate fog, and decision delay.

I use four behavioural indicators because they show up early, they are observable, and they are hard to spin:

Decision latency: Time from “we need a decision” to “we have a decision people can execute.”

Revisit rate

Truth travel time

Mandate clarity

When decision time stretches, everything downstream dilutes. It quickly becomes the norm.

Hiring gets delayed.

Pricing gets delayed.

Product cuts get delayed.

Customer decisions get delayed.

The company starts living in hope.

That is the decision burn rate, the behavioural cousin of cash burn. Revisit rate is the frequency with which the same decision is returned.

A decision that returns twice was never a decision. It was a discussion with a calendar invite.

High revisit rate creates rot. People stay busy. Work expands. Accountability dissolves. Execution becomes optional.

The CEO gets the worst outcome of all.

Motion without progress becomes the norm.

Truth travel time: time from “someone knows” to “leadership knows” to “you know.”

This is a shadow metric.

In healthy companies, bad news moves fast. In distressed ones, it moves slowly. It gets filtered. It arrives packaged. Not because people are evil but because we’re human and often protect ourselves, and the narrative.

A mini office meeting test: Count how often you hear:

Who owns this

Can we do this

Do we have approval

Are we aligned

That language is data. It reveals whether your system is running on permission seeking, not execution.

Permission seeking feels safe, but it also kills speed.

The sentence I hear most often

Behaviour debt is rarely dramatic. It shows up as small frictions that keep repeating:

Decisions that take weeks, then get revisited anyway.

Projects that keep getting one more review

Meetings where everyone agrees and nothing changes

People are waiting for direction, then reworking when direction changes.

Bad news that arrives late, then arrives softened.

Leaders who say “we are aligned” while everyone is quietly hedging.

The sentence I hear most often after the fact is a classic:

“We thought we had more time.”

You almost never do.

I’ve watched this pattern destroy companies for 30 years. The data backs it up: organisations with high decision velocity show materially better growth and profitability. But you don’t need a consultant to tell you what you already feel in your board meetings.

So, behaviour measurement needs one rule: Measure behaviour to see reality.

Use it to remove friction, and not to reward speed.

The test is simple

Think of the last decision your board debated for more than two weeks.

Now ask:

Who actually owns it?

What happens if we wait 30 more days?

Who’s waiting for that decision to move?

If you can’t answer those cleanly, you’re not “gathering data.” You’re accumulating behaviour debt.

It will show up later as performance debt.

Where to start

If you want to start measuring business behaviour this week, start with one metric: Truth travel time.

Ask your team:

What is the worst thing we know right now?

Who knows it?

When did they know it?

When did I know it?

The gap between those two timestamps is your early warning signal.

Then stop talking. The first answer is usually polite. The second answer is usually true.

The fastest way to spot behaviour debt is to measure it.

Start with truth travel time: What’s the worst thing your team knows right now? When did they know it? When did you know it?

The gap between those two timestamps is your early warning signal.

If you want to start measuring this properly, here are my free tools:

Decision Latency Calculator: decisionlatency.earlywarningindex.com

Pre Mortem Generator: premortem.earlywarningindex.com

Distress Is the New Normal: 2025’s Perfect Storm for SMEs, and the Turnaround Playbook

While venture headlines obsess over unicorn valuations, the backbone of every economy—small and mid-sized businesses—is running out of slack.

Founders and boards don’t need another round of doom-scrolling statistics to know the operating climate has shifted. However, the latest data make the picture hard to ignore: structural pressures are now the rule, not the exception, and they demand a turnaround mindset long before a crisis announcement is made.

The Hard Numbers Behind the Mood

The signals are unambiguous.

42% of small businesses ended 2024 with negative or break-even growth.

54 % already face cash-flow stress, with limited reserves to buffer even a modest revenue dip.

80 % are feeling sustained inflation, which compresses margins even when topline sales hold steady.

83 % report talent-retention challenges, driven mainly by competitive pay and poaching from larger firms.

Those are not abstract percentages; they describe the daily operating reality for the companies that generate most private-sector employment. And it’s not just a local issue.

Across EMEA, 97% of executives expect geopolitical disruptions to trigger corporate distress within the next 12 months.

Seventy-four percent predict a regional recession within two years.

When asked which industries they expect to suffer the most, respondents listed automotive at 82%, retail at 43%, and manufacturing at 36%, with technology splitting opinions as AI creates both opportunity and risk in equal measure.

Taken together, these numbers paint a single picture: 2025 is not a year for incremental adjustments. It is a pivotal year for small and mid-sized enterprises, as well as for the investors and boards that back them.

Four Pressure Points Every Board Should Confront

Distress at this scale doesn’t sneak up overnight. It builds through identifiable weaknesses. Here are the four I see most often in turnaround work, each paired with immediate actions.

1. Liquidity Triage

Cash flow is oxygen. Boards should insist on weekly or 30-day minimum, rolling forecasts and move early on receivables, supplier terms, and unnecessary working-capital drains. Waiting for a quarterly review is waiting too long.

2. Pricing Power

With inflation still embedded, annual price reviews are obsolete. Leadership teams need a quarterly, or even monthly, discipline for revisiting pricing models, customer segmentation, and cost pass-through.

3. Talent Hedge

When 83% of SMEs cite competitive pay as their top retention issue, cutting payroll isn’t a viable plan.

Explore profit-sharing, flexible scheduling, and equity participation before competitors lure away critical people.

4. Fast Diagnostics

The most overlooked tool is a structured early-warning system.

A 20-minute Recovery Odds Index assessment pinpoints whether liquidity, pricing, talent, or leadership alignment is the acute risk. Acting on those signals in week one, not quarter two, separates a manageable challenge from a full-blown crisis.

Opportunities Hidden in the Storm

It’s easy to read these figures and default to defensive thinking. Yet, downturns have always created opportunities for operators who move quickly and investors who look beyond the panic. Three stand out:

Early-Warning Systems and AI Analytics:

Seventy-seven percent of companies now use some form of AI to improve operational efficiency. The same predictive tools that forecast customer churn can identify cash-flow gaps or supply-chain risks before they become fatal.

Out-of-Court Restructurings:

Roughly three-quarters of executives expect growth in out-of-court restructurings—faster, cheaper, and less reputation-damaging than formal insolvency. Boards that prepare contingency plans now can negotiate from a position of strength later.

Active Portfolio Oversight:

For investors, passive monitoring is no longer enough. The days of quarterly board packets and “call us if you need us” governance are gone. Continuous data-driven oversight—and the willingness to step in with interim leadership—will define the portfolios that emerge as leaders.

The Turnaround Playbook

Whether you sit on a board, manage a fund, or run the company yourself, the playbook starts the same way:

Diagnose Early – Use objective tools to identify where stress is building.

Stabilize Liquidity – Cash buys time; everything else follows.

Reframe Strategy – Cut to the profitable core; exit distractions.

Strengthen Leadership – Interim executives or outside specialists raise success odds by 30–50 %.

Communicate Relentlessly – Employees, lenders, and investors must hear the plan before rumors fill the gap.

These are not theoretical steps. They are the consistent patterns behind successful recoveries across sectors and geographies.

2025: The Decisive Year

The convergence of high startup failure rates, investor overconfidence, persistent inflation, and geopolitical risk makes 2025 more than just another economic cycle. For SMEs, it is a make-or-break moment.

Founders who treat these pressures as temporary headwinds will burn valuable months. Boards that wait for “clearer signals” will miss the narrow window when a fast pivot can still protect enterprise value.

The companies that survive—and even thrive—will be the ones that treat distress as the new normal, act before the red lights flash, and build systems to detect trouble when it’s still a whisper.

That’s why I built the Recovery Odds Index: a quick, data-driven way to surface those signals and force the hard conversations early. Whether you use my tool or another, the imperative is the same.

2025 won’t reward optimism. It will reward preparedness.

Business Valuation Early Warning Signs: Stop Value Loss Before It Starts

A company’s value rarely collapses overnight. It erodes through missed signals—falling margins, rising debt, or silent market shifts. Learn how to detect early valuation warning signs and act before real value is lost.

Smart investors don't wait for disaster to strike. They watch for warning signs that signal trouble ahead, especially when it comes to business valuations. Your investment could be losing value right now — and you might not even know it.

Business valuation isn't just about numbers on a spreadsheet. It's about understanding the health of your investment and spotting problems before they destroy value. The companies that survive and thrive are those that identify warning signs early and take decisive action.

Most business failures aren't sudden disasters. They're slow bleeds that start with subtle warning signs — declining margins, rising debt, operational inefficiencies — that compound over time until recovery becomes impossible. The key is knowing what to look for and acting fast when you see it.

What is Business Valuation?

Business valuation determines what a company is worth based on multiple factors, including financial performance, market position, and prospects. It's not a one-time calculation — valuations fluctuate based on internal and external forces that can either build or destroy value.

The most common valuation methods include discounted cash flow analysis, which projects future earnings; comparable company analysis, which benchmarks against similar businesses; and asset-based approaches that focus on tangible and intangible assets. Each method provides different insights into company value and potential risks.

Business valuations serve critical purposes: mergers and acquisitions, investment decisions, financial reporting, tax planning, and strategic planning. But here's what most people miss — valuation is also your best early warning system for identifying problems that could torpedo your investment.

Why Early Warning Signs Matter in Business Valuation

Early detection saves companies. Period.

When you catch problems early, you have options: restructure operations, renegotiate debt, pivot strategy, or even exit before losses mount. Wait too long, and your options disappear. We've seen too many high-potential businesses fail because leadership ignored warning signs until it was too late.

The data is clear: companies that implement early warning systems have significantly higher survival rates during economic downturns and market disruptions. They preserve more value for stakeholders and maintain better relationships with customers, suppliers, and lenders.

Think of early warning signs as your business insurance policy. You hope you never need it, but when a crisis hits, having that system in place makes the difference between survival and failure.

Key Early Warning Signs in Business Valuation

Declining Revenue or Profit Margins

Revenue decline is often the first domino to fall. Watch for consistent month-over-month decreases, seasonal patterns that don't recover, or margin compression that can't be explained by temporary market conditions.

Profit margins tell an even more urgent story. When margins shrink, it signals either rising costs that can't be controlled or pricing pressure that suggests competitive weakness. Both scenarios demand immediate attention.

Increasing Debt Levels

Debt isn't always bad, but when debt grows faster than revenue or when debt service begins consuming disproportionate cash flow, you're looking at a red flag that can quickly become a crisis.

Pay special attention to debt-to-equity ratios and interest coverage ratios. These metrics reveal whether the company can service its obligations during tough times.

Deteriorating Cash Flow

Cash flow problems kill more businesses than profitability issues. A company can show profits on paper while bleeding cash due to inventory buildup, slow collections, or operational inefficiencies.

Monitor cash conversion cycles closely. When the time between investment and cash return extends, liquidity problems aren't far behind.

Loss of Key Customers or Market Share

Customer concentration risk is a silent killer. When one or two major customers represent significant revenue, their departure creates immediate valuation pressure.

Market share loss signals competitive weakness that often accelerates. Companies rarely lose market share gradually — they lose it in chunks that compound over time.

Operational Inefficiencies

Rising operational costs relative to revenue indicate management problems that often spread throughout the organization. These inefficiencies compound and become harder to fix as they become embedded in company culture.

Look for increasing employee turnover, quality control problems, or delivery delays — all indicators of operational stress that impacts valuation.

Regulatory or Legal Issues

Regulatory changes can destroy valuations overnight. Companies that fail to adapt to new regulations or face legal challenges often see their valuations collapse before they can respond effectively.

Monitor compliance costs and legal expenses. When these begin consuming significant resources, they're diverting capital from value-creating activities.

Technological Disruption

Technology changes markets faster than most companies can adapt. When your industry faces technological disruption, early adaptation means survival. Delayed response often means obsolescence.

Watch for changes in customer behavior, new competitive threats, or shifts in how your industry operates. These changes create valuation pressure that accelerates over time.

Tools and Techniques for Identifying Early Warning Signs

Financial Statement Analysis

Monthly financial statements provide your first line of defense. Don't wait for quarterly reports — establish monthly monitoring of key metrics, including cash flow, margins, and debt ratios.

Focus on trend analysis rather than absolute numbers. A 10% revenue decline might be acceptable during economic downturns, but a consistent monthly decline over six months signals deeper problems.

Market and Industry Analysis

Your company doesn't operate in isolation. Industry trends, competitive pressures, and market shifts directly impact valuation. Establish regular competitive analysis and market monitoring.

Track industry benchmarks for key performance indicators. When your company begins underperforming industry standards, dig deeper to understand why.

Customer and Supplier Analysis

Customer feedback provides early warning signals that financial statements miss. Declining customer satisfaction often precedes revenue declines by months.

Supplier relationships also matter. When suppliers tighten credit terms or demand faster payments, they're signaling concerns about your company's financial stability.

Employee Feedback and Surveys

Employees see problems developing long before they show up in financial statements. High-performing employees leave troubled companies first, taking institutional knowledge with them.

Regular employee surveys can identify operational problems, management issues, or cultural problems that eventually impact financial performance.

Expert Opinions and Consultations

Outside perspectives cut through internal bias and denial. External consultants, board advisors, or industry experts can identify blind spots that internal teams miss.

Regular third-party assessments provide objective analysis of company health and early identification of developing problems.

Turnaround Readiness Assessment

Comprehensive assessment tools like the Turnaround Readiness Assessment evaluate 42 critical factors that determine business survival odds. These assessments provide objective data for decision-making and identify the highest-impact issues requiring immediate attention.

The assessment covers financial health, operational efficiency, market position, management capability, and stakeholder relationships — all critical factors in business valuation.

Taking Action on Early Warning Signs

When you identify warning signs, speed matters more than perfection. Start with a thorough assessment of your business health using objective tools that cut through bias and emotion.

Develop a turnaround plan with clear objectives, specific timelines, and assigned responsibilities. Focus on the highest-impact issues first — often these are cash flow, customer retention, or operational efficiency problems.

Communication with stakeholders becomes critical during crisis periods. Transparent, frequent updates build trust and support that you'll need for successful turnaround efforts.

Implement operational improvements immediately. Don't wait for perfect solutions — make incremental improvements while developing longer-term strategies.

Consider restructuring options for debt or raising additional capital, but remember that these are temporary solutions. The underlying business problems must be addressed for sustainable recovery.

Monitor progress closely and adjust your plan based on results. Weekly reviews during crisis periods ensure you stay ahead of developing problems.

Protect Your Investment Before It's Too Late

Early warning signs in business valuation aren't suggestions — they're urgent alerts that demand immediate action. The companies that survive economic downturns and market disruptions are those that establish early warning systems and act decisively when problems emerge.

Don't wait until your next board meeting or quarterly review to address developing problems. Every day you delay action reduces your options and increases potential losses.

Ready to know where your business stands? The Turnaround Readiness Assessment provides an objective evaluation of your survival odds with actionable recommendations for improvement. In just 20 minutes, you'll know if your business will survive the next 12 months and exactly what to fix first.

Your investment is too valuable to leave to chance.