Below 60%: When Your Company Is Slowing Down

A score below 60 percent is an early warning. Execution slows, decisions drag, and risk builds long before it shows up in the numbers.

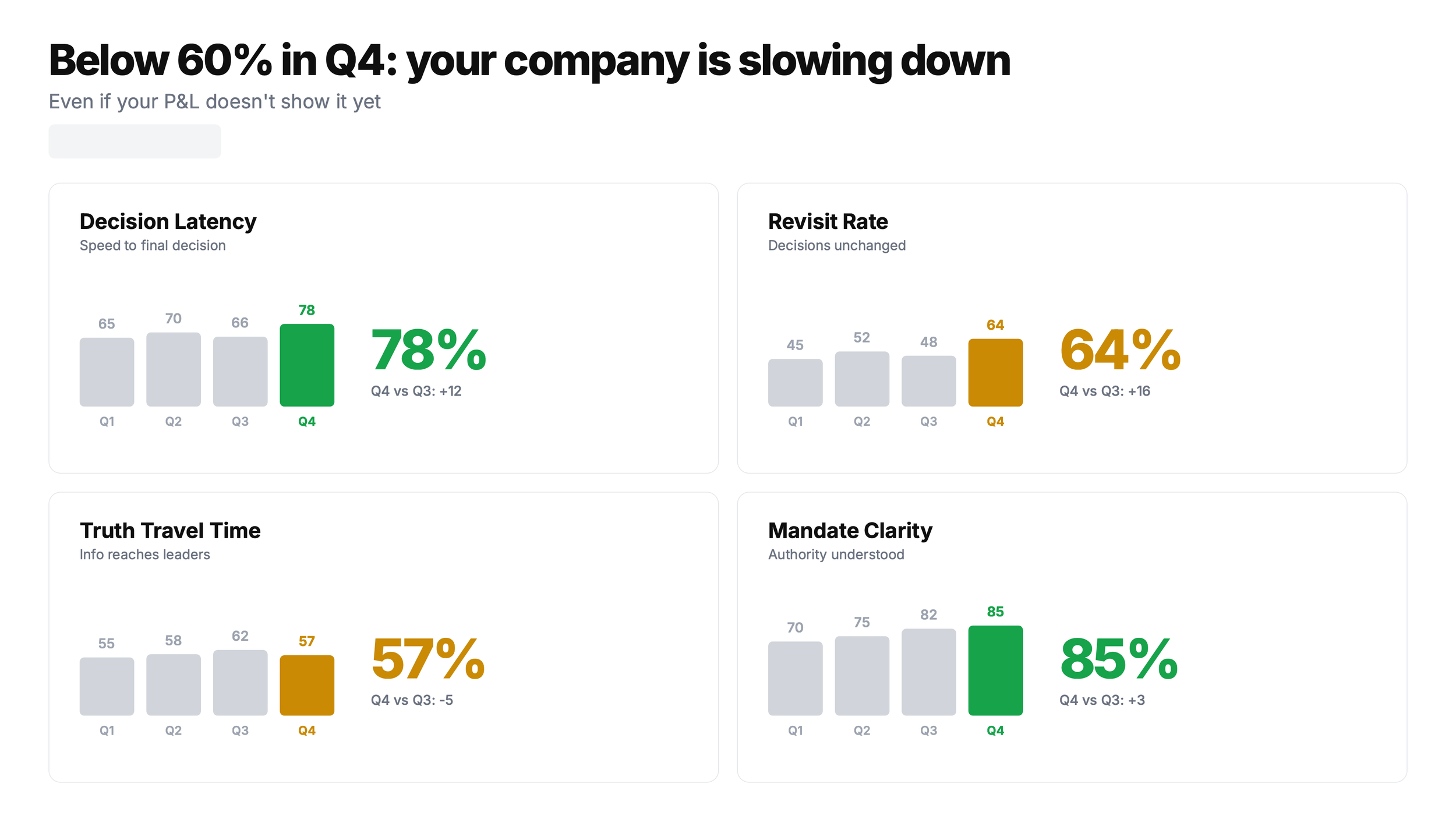

Four behavioural signals that show up 90 days before your P&L does.

A founder recently showed me his numbers, and they looked healthy. Revenue on plan. Pipeline green. Cash runway stable, all good.

Then he said something that did not match the numbers:

“I think we’re slowing down. I can’t just put my finger on exactly what and where to start”

He was right. The warning signs were there, subtle and not obvious. They were not yet showing in the P&L.

Here’s what’s going on:

Performance tells you what happened. The numbers are history. If you want to look into the crystal ball, you must start measuring your business behaviour.

This is the trap many SMEs are walking into.

Most companies measure outcomes, then reverse engineer a story and a conclusion to follow. Typically something like this:

When the quarter is good, the story is execution.

When the quarter is bad, the story is the market or product.

Behaviour sits underneath both stories. Behaviour is the mechanism.

I call it behaviour debt.

When behaviour changes for the worse, you get slower. You do not collapse immediately. And slow compounds.

What you can measure before the numbers move

You stop waiting for the P&L to give you permission to act.

You start measuring the stuff that moves before the numbers move: time, rework, silence, mandate fog, and decision delay.

I use four behavioural indicators because they show up early, they are observable, and they are hard to spin:

Decision latency: Time from “we need a decision” to “we have a decision people can execute.”

Revisit rate

Truth travel time

Mandate clarity

When decision time stretches, everything downstream dilutes. It quickly becomes the norm.

Hiring gets delayed.

Pricing gets delayed.

Product cuts get delayed.

Customer decisions get delayed.

The company starts living in hope.

That is the decision burn rate, the behavioural cousin of cash burn. Revisit rate is the frequency with which the same decision is returned.

A decision that returns twice was never a decision. It was a discussion with a calendar invite.

High revisit rate creates rot. People stay busy. Work expands. Accountability dissolves. Execution becomes optional.

The CEO gets the worst outcome of all.

Motion without progress becomes the norm.

Truth travel time: time from “someone knows” to “leadership knows” to “you know.”

This is a shadow metric.

In healthy companies, bad news moves fast. In distressed ones, it moves slowly. It gets filtered. It arrives packaged. Not because people are evil but because we’re human and often protect ourselves, and the narrative.

A mini office meeting test: Count how often you hear:

Who owns this

Can we do this

Do we have approval

Are we aligned

That language is data. It reveals whether your system is running on permission seeking, not execution.

Permission seeking feels safe, but it also kills speed.

The sentence I hear most often

Behaviour debt is rarely dramatic. It shows up as small frictions that keep repeating:

Decisions that take weeks, then get revisited anyway.

Projects that keep getting one more review

Meetings where everyone agrees and nothing changes

People are waiting for direction, then reworking when direction changes.

Bad news that arrives late, then arrives softened.

Leaders who say “we are aligned” while everyone is quietly hedging.

The sentence I hear most often after the fact is a classic:

“We thought we had more time.”

You almost never do.

I’ve watched this pattern destroy companies for 30 years. The data backs it up: organisations with high decision velocity show materially better growth and profitability. But you don’t need a consultant to tell you what you already feel in your board meetings.

So, behaviour measurement needs one rule: Measure behaviour to see reality.

Use it to remove friction, and not to reward speed.

The test is simple

Think of the last decision your board debated for more than two weeks.

Now ask:

Who actually owns it?

What happens if we wait 30 more days?

Who’s waiting for that decision to move?

If you can’t answer those cleanly, you’re not “gathering data.” You’re accumulating behaviour debt.

It will show up later as performance debt.

Where to start

If you want to start measuring business behaviour this week, start with one metric: Truth travel time.

Ask your team:

What is the worst thing we know right now?

Who knows it?

When did they know it?

When did I know it?

The gap between those two timestamps is your early warning signal.

Then stop talking. The first answer is usually polite. The second answer is usually true.

The fastest way to spot behaviour debt is to measure it.

Start with truth travel time: What’s the worst thing your team knows right now? When did they know it? When did you know it?

The gap between those two timestamps is your early warning signal.

If you want to start measuring this properly, here are my free tools:

Decision Latency Calculator: decisionlatency.earlywarningindex.com

Pre Mortem Generator: premortem.earlywarningindex.com

Early Warning Signs of Business Failure: A Framework for Boards & Founders

Kenneth Dalsgaard presenting the Early Warning Index categories and how warning signals develop months before financials move.

Key Takeaways: Early Warning Signs of Business Distress

Financials Are Lagging Indicators: By the time trouble appears on the P&L or Balance Sheet, the decline has already begun. Effective turnaround requires monitoring operational "friction" rather than just financial fire.

The "Strategic Drift" Problem: 50% of SME failures are avoidable. They occur because leaders focus on their specific expertise (their "recipe") while ignoring 45 distinct warning signs in areas they don't watch.

The 6 Pillars of Prevention: The Early Warning Index™ (EWI) predicts insolvency risk by auditing six core areas:

Priorities: Is bad news traveling fast or being hidden?

P&L: Is the revenue forecast accurate or a "wish list"?

Position: Is strategy based on evidence or assumptions?

Pipeline: Are "zombie deals" inflating the sales outlook?

People: Is the team busy but producing unstable results?

Power: Will investors actually fund the next 6 months?

Actionable Insight: The EWI acts as a "smoke detector" for Boards and Founders, cutting through optimism bias to identify risk months before a crisis hits.

50% of business failures could be avoided with early intervention. If businesses had "smoke detectors", most leaders would remove the batteries because the alarms are annoying.

The Reality of Drift

I've spent 30 years as a Founder, Investor, and CEO. I've built companies, invested in businesses, and stepped in as CEO in others.

In every role, I noticed the same pattern. It wasn't that we were ignoring problems. We were focused on what we knew best. As leaders, we all have a "recipe." If you are a product founder, you look at features. If you are a sales CEO, you look at the pipeline. We rely on our experience to filter the noise and do the best we can.

But often, while we focus on the areas we know, or can see in front of us, minor issues in the areas we don't watch start to compound. By the time they appear in the monthly board report, the decline has already begun.

This slow drift is measurable long before it becomes dangerous if you know how and where to look.

From Recovery to Early Warning

A few years ago, I built the Recovery Odds Index™ to measure if a distressed business can be saved and how. It worked. People quickly started asking to modify it for prevention, as an early warning tool.

So, I built the Early Warning Index™ (EWI). It's a practical operating tool. It is a smoke detector. It catches the quiet deviations, the "kindling", before they turn into a blaze.

If your first warning sign comes from the P&L or the balance sheet, congratulations, you're already late.

EWI gives you signals much earlier than the numbers ever will.

The 6 Places Truth Hides (The EWI Framework)

We track 45 distinct data points to measure warning signs. We don't look for the fires; we look for the friction.

Healthy companies show consistency across these areas. Drifting companies don't.

1. Priorities (Leadership and Management)

The warning signs: In healthy companies, bad news travels fast. In crisis companies, bad news takes the stairs while good news takes the elevator.

The Metric: We track 11 leadership signals, but the most predictive is the quiet deviations. Does the Board ask hard questions? Do they avoid demotivating the founder? Does everyone work aligned on the right issues?

If your Board pack is filled with nothing but good news while the runway keeps getting shorter, it's time to realize that you're not really managing the company; you're just putting on a show. In high-functioning teams, participants address friction early on because they're all focusing on the same set of facts.

2. P&L (Financial Health)

The warning signs: Most companies treat cash like a strategic choice rather than a hard constraint.

The Metric: Beyond standard liquidity, we weigh Forecast Accuracy heavily. If your revenue forecasts are "rarely accurate" (a specific score in our model), you don't have a forecast; you have a wish list. Drifting companies often claim a short runway is a "strategic choice." It rarely is. It's usually a lack of options disguised as strategy.

A healthy financial team demonstrates consistent forecasting patterns and realistic planning.

3. Position (Product and Strategy)

The warning signs: The gap between what you think you sell and what customers actually buy.

The Metric: Of the 7 strategy markers we audit, the most dangerous is Product Evidence. Companies in decline rely on "assumptions only." Healthy companies show repeat customers and referrals. If your strategy is "interpreted differently across teams", you are simply burning cash to accelerate in a circle.

Successful companies base their strategy on customer behavior rather than relying on optimism.

4. Pipeline (Sales and Retention)

The warning signs: Optimism. I have never met a founder who wasn't optimistic about next quarter.

The Metric: The Index audits the whole funnel and specifically flags the "Zombie Pipeline", deals marked "closing soon" for 90+ days. If your churn is creeping into the 20-35 percent range, your bucket has a hole that no amount of marketing spend can fix.

Healthy pipelines exhibit predictable movement and maintain controlled churn.

5. People (Operations and Turnover)

The warning signs: Drifting companies are rarely lazy. They are exhausted. The hallmark of an early crisis is a sudden explosion of internal busyness.

The Metric: High turnover is a lagging indicator. We look for the leading indicator: Operational Bottlenecks. If your team is working 80-hour workweeks but delivery is "unstable or unpredictable", you don't have a resource problem; you have a process problem.

Healthy companies deliver consistently and execute predictably without causing burnout.

6. Power (Shareholder Relations)

The warning signs: Assuming the investors will be there when you need them.

The Metric: We assess Capital Availability across 3 dimensions, primarily Shareholder Trust. When trust drops, the checkbook closes long before the ask is made. We assess whether shareholders can and are willing to fund the next 6 to 12 months. Don't assume the answer is "yes." Ask.

Healthy companies maintain aligned expectations and have transparent capital plans.

Why SMEs Break

Most startups and SMEs are agile on paper but fragile in reality. They can pivot, but they lack the capital to absorb a long period of stagnation.

What is the difference between survival and collapse? It's how long the early warning signs go ignored. The advantage is that these indicators can be identified and acted upon well before they become costly.

The Takeaway

The Early Warning Index cuts through the optimism bias, the defensive storytelling, and the "everything is fine" updates. It gives Management, Boards, and Investors a shared language for risk and a way to act earlier with confidence.

You get a several-page report with emerging risks, short-term and long-term priorities, and a clear early warning map of where drift is likely to start.

Run the EWI once every quarter.

Founders: You get a clear map of where drift is starting before it becomes visible in the numbers.

Investors: Send this to your portfolio companies before their next quarterly update.

It's an easy-to-use tool that shows you exactly where the house is getting warm.

👉 Take the free test or see a sample report:

https://earlywarningindex.com

You get your top-level early warning score for free.

If you want the full 45-indicator report with risks and priorities, it's €199.

Strategic Blind Spots: The Hidden Threats to Business Survival

Every leadership team has blind spots — unseen assumptions and habits that quietly steer decisions off course. This post reveals the hidden biases that block timely action and shows how to surface them before they turn into a full-blown crisis.

Most business failures aren't dramatic collapses. They're slow bleeds that start with strategic blind spots — critical vulnerabilities hiding in plain sight until it's too late to recover.

Strategic blind spots kill more businesses than market crashes, competitive threats, or economic downturns. They're the gaps in leadership vision that allow small problems to compound into existential crises. The data tells a stark story: companies that fail to identify and address strategic blind spots have 3x higher failure rates during market disruptions.

Here's what separates surviving companies from failing ones: successful organizations establish systematic processes to identify blind spots before they destroy value. They don't rely on intuition or hope — they use objective assessment tools and external perspectives to surface hidden risks that internal teams consistently miss.

This post reveals how strategic blind spots develop, why they're so dangerous, and exactly what you need to do to identify them before they kill your business.

What Are Strategic Blind Spots?

Strategic blind spots are critical risks or opportunities that leadership consistently fails to recognize, despite clear warning signs. They're not random oversights — they're systematic gaps in organizational awareness that create predictable patterns of failure.

These blind spots develop when internal perspectives become too narrow, when success breeds complacency, or when organizational culture discourages challenging established thinking. They're reinforced by confirmation bias, groupthink, and the dangerous assumption that past success guarantees future performance.

Common strategic blind spots include:

Market Position Erosion: Leadership believes competitive position remains strong while market share quietly deteriorates and customer satisfaction scores decline.

Operational Inefficiency: Management focuses on revenue growth while operational costs spiral out of control, destroying margins and cash flow.

Technology Disruption: Organizations dismiss emerging technologies as irrelevant while competitors gain insurmountable advantages through early adoption.

Customer Behavior Shifts: Companies continue serving customers the same way while preferences, expectations, and buying patterns fundamentally change.

Financial Health Deterioration: Leadership celebrates revenue milestones while underlying financial metrics — debt levels, cash conversion, working capital — signal impending crisis.

Why Strategic Blind Spots Matter

Strategic blind spots don't just hurt performance — they destroy business valuations and eliminate recovery options.

When blind spots persist, they compound exponentially. A 10% market share loss becomes 25%, then 50%. Customer dissatisfaction spreads through reviews and word-of-mouth. Operational inefficiencies become embedded in company culture. Financial problems accelerate until liquidity crises eliminate strategic options.

The valuation impact is immediate and severe. Investors and acquirers can spot blind spots that internal leadership misses. When strategic vulnerabilities become obvious to external parties, valuations collapse faster than internal teams can respond.

Companies with unaddressed strategic blind spots face:

Valuation destruction: Businesses lose 40-70% of value when blind spots trigger crisis conditions

Limited exit options: Strategic buyers avoid companies with obvious blind spots

Stakeholder confidence loss: Boards, investors, and lenders withdraw support when blind spots indicate management failure

Competitive disadvantage: Competitors exploit blind spots to capture market position and key customers

The most dangerous aspect of strategic blind spots is time compression. Once external markets recognize what internal leadership missed, recovery windows shrink from years to months — or disappear entirely.

Early Warning Signs of Strategic Blind Spots

Strategic blind spots don't develop overnight. They create warning patterns that objective assessment can identify before damage becomes irreversible.

Leadership Overconfidence

When leadership consistently dismisses external feedback, avoids challenging conversations, or relies heavily on past success to justify current decisions, blind spots are developing. Overconfident leadership stops asking hard questions and starts making assumptions that compound into strategic vulnerabilities.

Internal Echo Chambers

Organizations with limited external input create environments where blind spots thrive. When advisory boards become ceremonial, when consultants are hired only to confirm existing beliefs, or when employee feedback is discouraged, critical perspectives disappear.

Declining Key Performance Indicators

Financial metrics often reveal blind spots before leadership recognizes them. Watch for margin compression, increasing debt service ratios, lengthening cash conversion cycles, or declining return on invested capital — all indicators that strategic assumptions aren't working.

Customer Behavior Changes

Customer feedback provides early warning signals that strategic approaches are failing. Declining Net Promoter Scores, increasing customer acquisition costs, or shortening customer lifecycle values indicate blind spots in market understanding.

Operational Warning Signs

Rising operational complexity, increasing employee turnover, quality control problems, or delivery delays often signal strategic blind spots in operational design or execution capabilities.

Market Position Erosion

Loss of key customers, declining win rates in competitive situations, or increasing price pressure from competitors indicate blind spots in competitive positioning or value proposition.

The Turnaround Readiness Assessment evaluates 42 critical factors that reveal strategic blind spots before they trigger crisis conditions. This comprehensive evaluation identifies the specific areas where blind spots are most likely to develop and provides objective data for strategic decision-making.

How to Uncover Strategic Blind Spots

Identifying strategic blind spots requires systematic approaches that overcome internal bias and organizational blind spots.

Objective External Assessment

Third-party assessment tools cut through internal bias and surface blind spots that leadership consistently misses. The Survival Diagnostic and Early Warning assessment provides a comprehensive evaluation of business health across financial, operational, market, and management dimensions.

This 20-minute assessment evaluates survival odds and identifies the highest-impact issues requiring immediate attention. Unlike internal analysis, external assessment eliminates confirmation bias and provides an objective perspective on strategic vulnerabilities.

360-Degree Stakeholder Analysis

Comprehensive stakeholder feedback reveals blind spots that internal perspectives miss. Systematic analysis of customer feedback, supplier relationships, employee surveys, and investor concerns provides multiple viewpoints on strategic effectiveness.

Customer interviews, supplier assessments, employee engagement surveys, and board feedback create comprehensive pictures of strategic performance that internal metrics often mask.

Competitive Intelligence

Regular competitive analysis identifies blind spots in market positioning and strategic assumptions. When competitors consistently win business, gain market share, or achieve superior operational performance, they're exploiting blind spots in your strategic approach.

Industry benchmarking, competitive win-loss analysis, and market research provide an external perspective on strategic effectiveness and identify areas where assumptions don't match market reality.

Scenario Planning and Stress Testing

Strategic scenarios test whether current approaches work under different conditions. When strategies break down under realistic stress scenarios — economic downturns, competitive disruption, regulatory changes — blind spots become visible before real-world conditions expose them.

Stress testing reveals strategic assumptions that work only under favorable conditions and identifies blind spots in risk management and contingency planning.

Advisory Board Engagement

Independent advisory board members provide an external perspective that reveals blind spots in strategic thinking. When advisory boards ask challenging questions, offer alternative viewpoints, or express concerns about strategic direction, they're identifying potential blind spots.

Effective advisory board engagement requires creating environments where challenging feedback is welcomed rather than dismissed, and where external perspectives are valued rather than ignored.

Real-World Impact of Strategic Blind Spots

Strategic blind spots create predictable patterns of business failure across industries and company sizes.

Technology Blind Spot: A successful manufacturing company ignored digital transformation trends for five years, believing its established customer relationships provided competitive protection. When competitors launched digital platforms that streamlined ordering and service delivery, the company lost 40% of its revenue within 18 months. The blind spot: assuming relationship strength compensated for operational disadvantage.

Market Blind Spot: A professional services firm focused on growing existing service lines while client needs shifted toward integrated solutions. Leadership celebrated revenue growth from traditional services while losing major clients to competitors offering comprehensive platforms. Recovery required complete business model restructuring after losing market position.

Financial Blind Spot: A growing technology company focused on user acquisition metrics while unit economics deteriorated. Leadership raised multiple funding rounds based on growth metrics while cash burn accelerated and customer lifetime values declined. When funding markets tightened, the company collapsed within months — despite strong user growth.

Operational Blind Spot: A retail chain expanded rapidly without investing in supply chain infrastructure. Leadership focused on store count growth while inventory management, distribution, and customer service capabilities failed to scale. Customer satisfaction declined, operational costs spiraled, and the company filed for bankruptcy despite revenue growth.

These failures share common patterns: leadership focused on favorable metrics while ignoring deteriorating fundamentals, internal perspectives reinforced strategic assumptions despite external evidence, and blind spots compounded until recovery became impossible.

Taking Action: Your Strategic Blind Spot Assessment

Strategic blind spots destroy business value faster than most leaders recognize. The companies that survive market disruptions and competitive threats are those that systematically identify and address blind spots before they trigger crisis conditions.

Start with an objective assessment. Internal analysis consistently misses blind spots that external tools identify immediately. The Turnaround Readiness Assessment provides a comprehensive evaluation of strategic vulnerabilities across 42 critical factors that determine business survival odds.

This assessment reveals:

Current survival probability based on objective data

Specific areas where blind spots are most likely to exist

Priority rankings for addressing identified vulnerabilities

Actionable steps for immediate implementation

Don't wait until external markets recognize what internal leadership missed. When blind spots become obvious to competitors, customers, or investors, recovery options disappear rapidly.

Eliminate Blind Spots Before They Eliminate Your Business

Strategic blind spots aren't inevitable — they're preventable through systematic assessment and proactive management. The difference between companies that thrive and those that fail is recognizing blind spots before they destroy value.

Every day you operate with unidentified blind spots is another day competitors gain advantages, customers lose confidence, and strategic options disappear. The cost of assessment is minimal compared to the cost of business failure.

Ready to know where your blind spots exist? The Recovery Odds Index provides an objective evaluation of your strategic vulnerabilities with specific recommendations for immediate action. In 20 minutes, you'll know exactly which blind spots threaten your business and what to fix first.

Your business survival depends on seeing what you're missing. Don't let strategic blind spots destroy what you've built.