The €100,000 Week: What Slow Decisions Actually Cost

What decision delays actually cost, and a free calculator to measure yours.

I told my board we needed to decide in two days. They said a week wouldn't matter. Three weeks later, that delay cost us 7 months, an extra funding round, and deals we'll never get back.

I call this the decision burn rate. And for most companies, it exceeds their monthly cash burn.

Every deferred decision accrues interest.

Delay replacing an underperforming sales leader by two quarters, and you've paid: lost revenue, cultural erosion (high performers leave when low performance is tolerated), and higher severance when the exit finally happens.

This is decision debt. It sits off your balance sheet but taxes every quarter.

The number your P&L never shows.

Most boards obsess over monthly cash burn. How fast are we spending?

But by the time cash gets tight, you've already lost. The real damage happened months earlier.

While you were in meetings, discussing, evaluating, getting "one more data point," the market moved. Competitors moved. Customers moved.

For a typical €2M revenue company, decision delays can cost €180,000 to €900,000 per year.

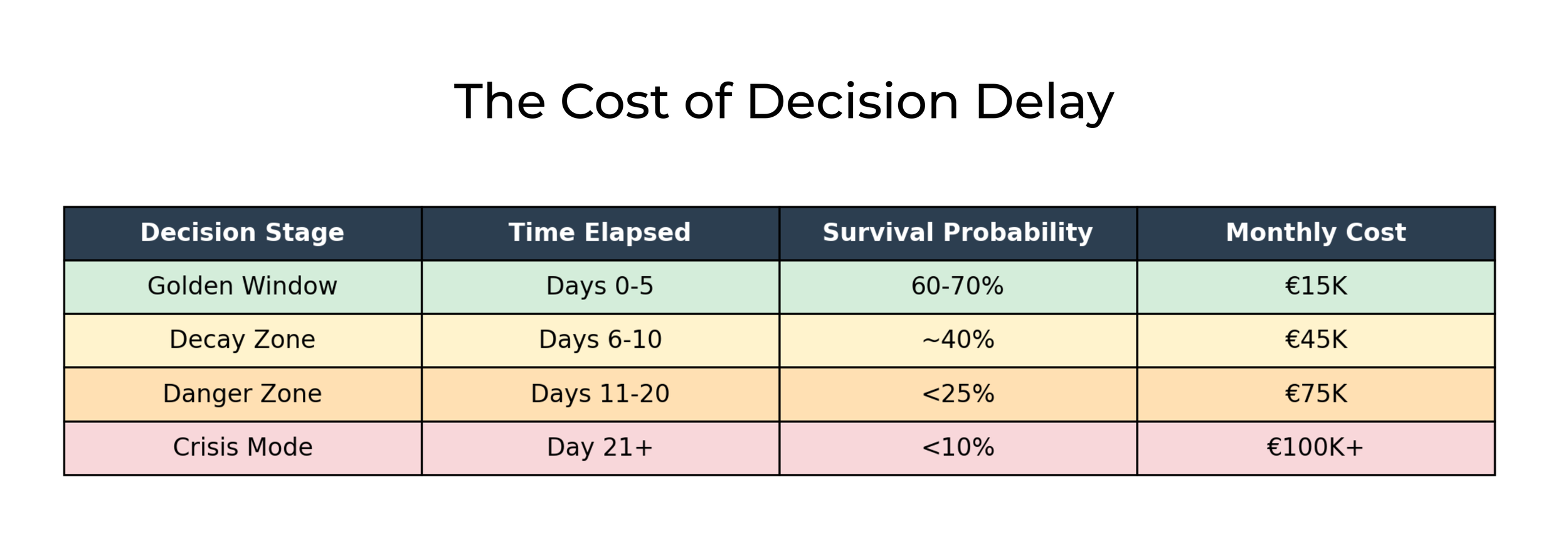

Tabel over Decision Latency hidden costs

There's no line in your financial statements for "revenue we would have captured if we'd moved six weeks faster."

But the cost is real.

Where it shows up

Decision delays aren't abstract. They show up as: • Deals lost to faster competitors • Product launches that miss market windows • Teams waiting for direction, then reworking when decisions finally change • Boards revisiting the same strategic questions quarter after quarter

The sentence I hear most often after the fact: "We thought we had more time."

You almost never do.

Why does this happen?

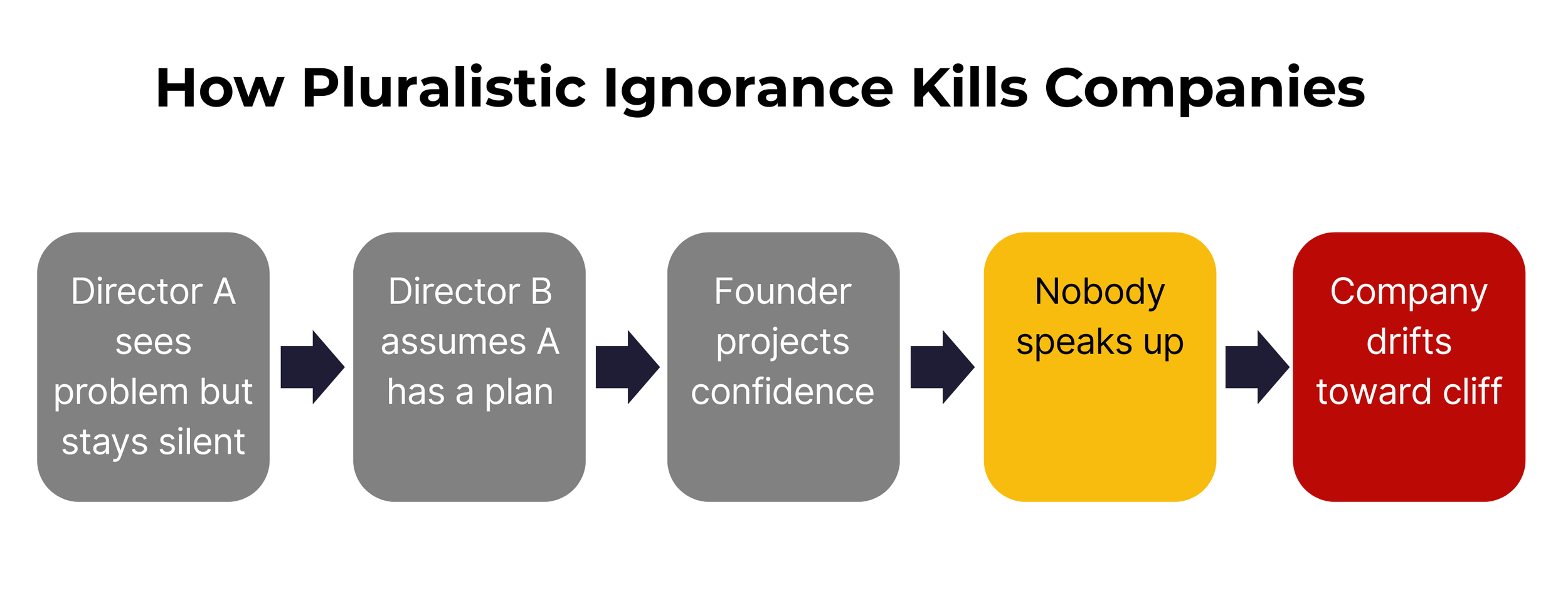

Pluralistic ignorance:

Director A thinks the forecast is delusional but stays silent to avoid seeming unsupportive.

Director B assumes Director A has a plan.

The founder projects confidence to keep investors happy.

Result: No one speaks. The motion passes. The company drifts closer to the cliff, not because anyone wanted it to, but because everyone was waiting for someone else to panic first.

Pluralistic ignorance in one slide: everyone sees the problem, nobody says it, the company drifts

One shadow metric I track:

How fast bad news travels.

In healthy companies, bad news moves in hours. In distressed ones, it gets delayed, filtered, and buried in footnotes.

If your investor update used to arrive on the 5th and now shows up on the 15th—that's not a scheduling issue. That's distress.

This matters most for companies with revenue under €10M, where a slow call can shift the entire trajectory.

If you're past that stage with distributed decision-making, the dynamics change.

Why I built the Decision Latency Calculator

That board meeting was years ago. But I still see the same pattern every week in the startups, SMEs, and investors I work with.

So that is why I built a free Decision Latency Calculator.

It's based on research that consistently shows that organizations that act within 5 days of recognizing a problem achieve survival rates of 60-70%.

Days 6-10? Survival drops to ~40%—boards are "gathering more data."

Past Day 10? Below 25%. At that point, you're not managing the crisis. The crisis is managing you.

You answer a short set of questions about how decisions actually happen in your company:

How long do they take?

How many people are involved?

How often do they get revisited?

What happens when conditions change?

You'll know: 1. Your actual decision speed—the number, not the feeling 2. The monthly cost in euros 3. Where decisions stall 4. Your survival odds if nothing changes

Takes a few minutes.

Your January board meeting

You know what needs to change.

You can show up and say: "We're working on it."

Or you can show up and say: "This is how long decisions actually take here. This is what the delay costs us per month. These are the bottlenecks."

One keeps the conversation vague. The other forces action.

The uncomfortable truth:

Optimism is a liability in a crisis. Your board's job isn't to be supportive, but skeptical.

Support often looks like enabling delusion. The most optimistic thing you can do is hunt for the pessimism hidden in your data.

The calculator is free: decisionlatency.earlywarningindex.com

Show up with numbers, not promises.

Send this to your CEO or board chair if decisions keep getting "one more review."